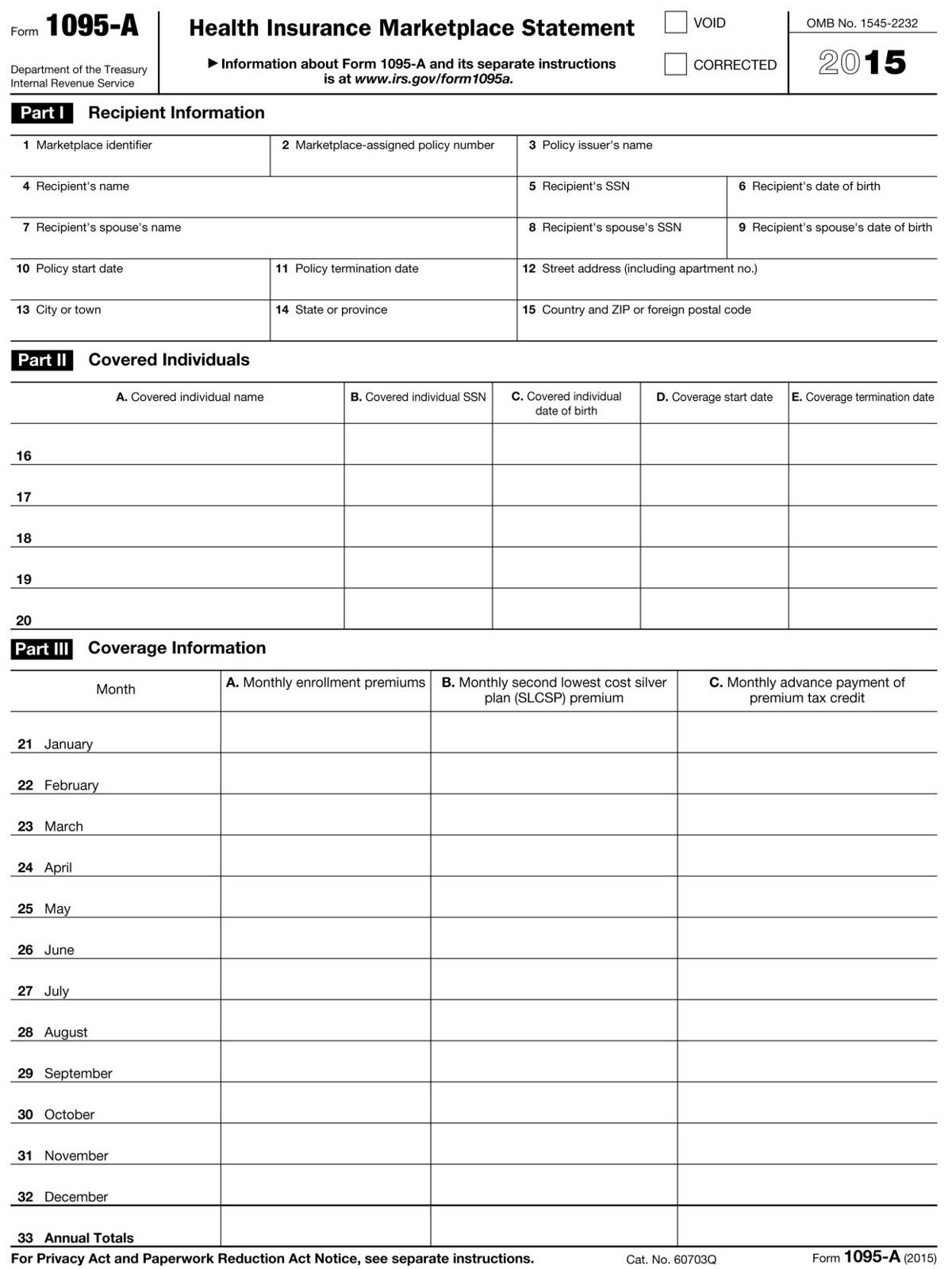

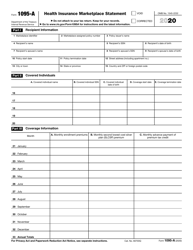

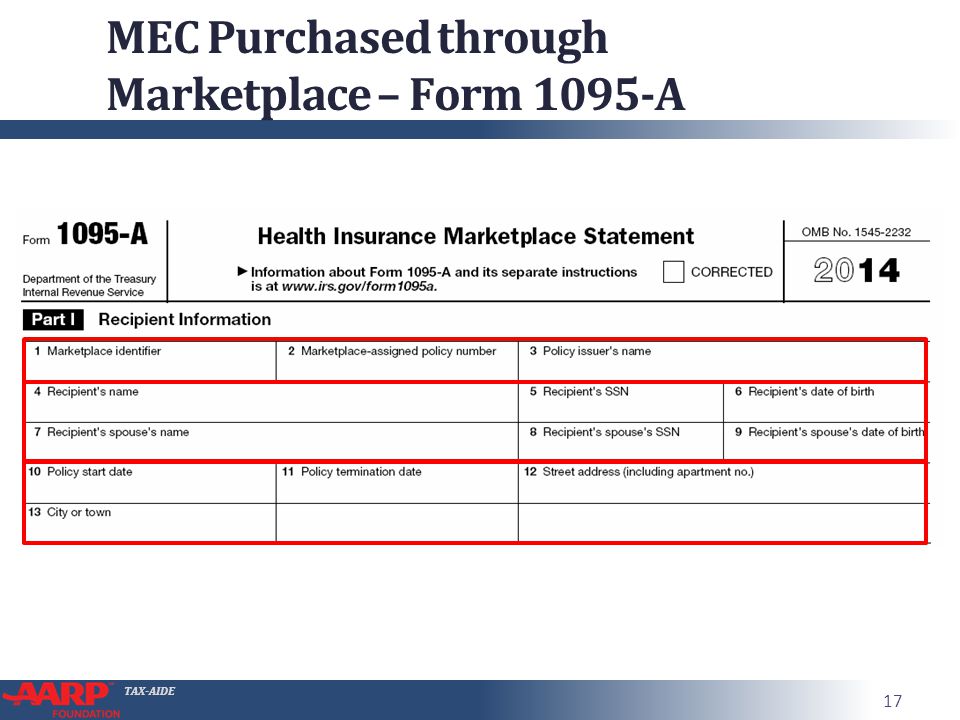

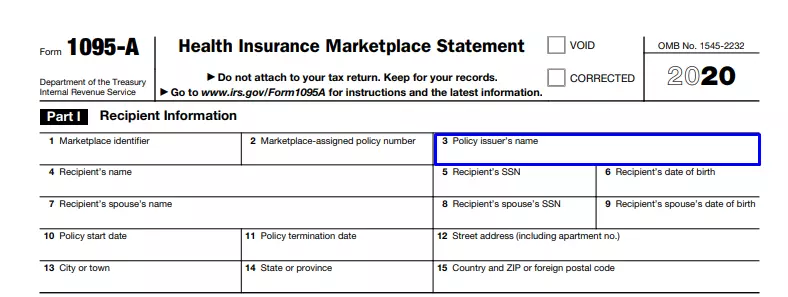

My 1095c doesnt say any of those it has my name ssn and my employer's name Browse Discuss Discover You do not report your Form 1095C on a tax return nor do you report the Form 1095C as a Form 1095A See this TurboTax support FAQ for a Form 1095CForm 1095C For Employer Provided Health Insurance Efilecom DA 13 PA 50 MOZ Rank Information on 1095C might be relevant if you had to purchase health insurance via the marketplace, see above;Form 1095A Health Insurance Marketplace Statement (15) free download and preview, download free printable template samples in PDF, Word and Excel formats 1 Marketplace identifier 2 Marketplaceassigned policy number 3 Policy issuer's name 4 Recipient's name

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

How to get marketplace 1095 form

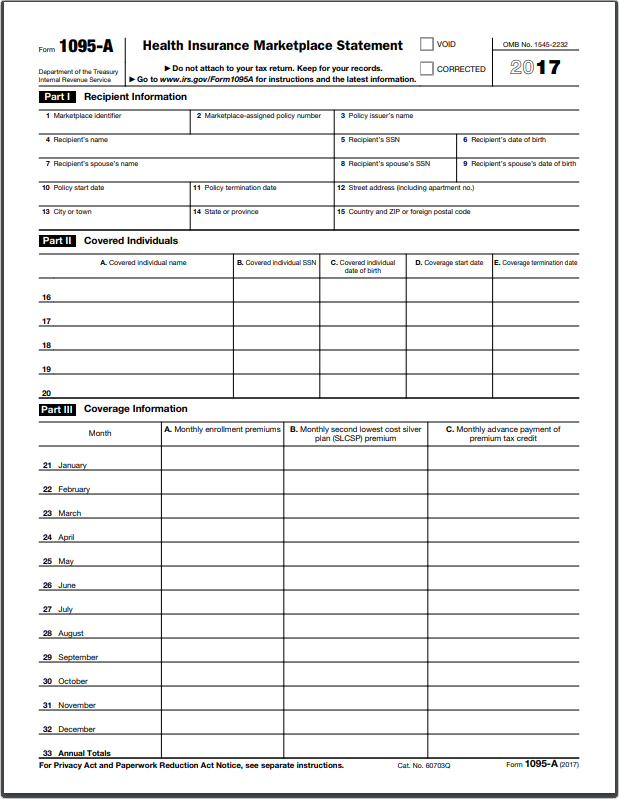

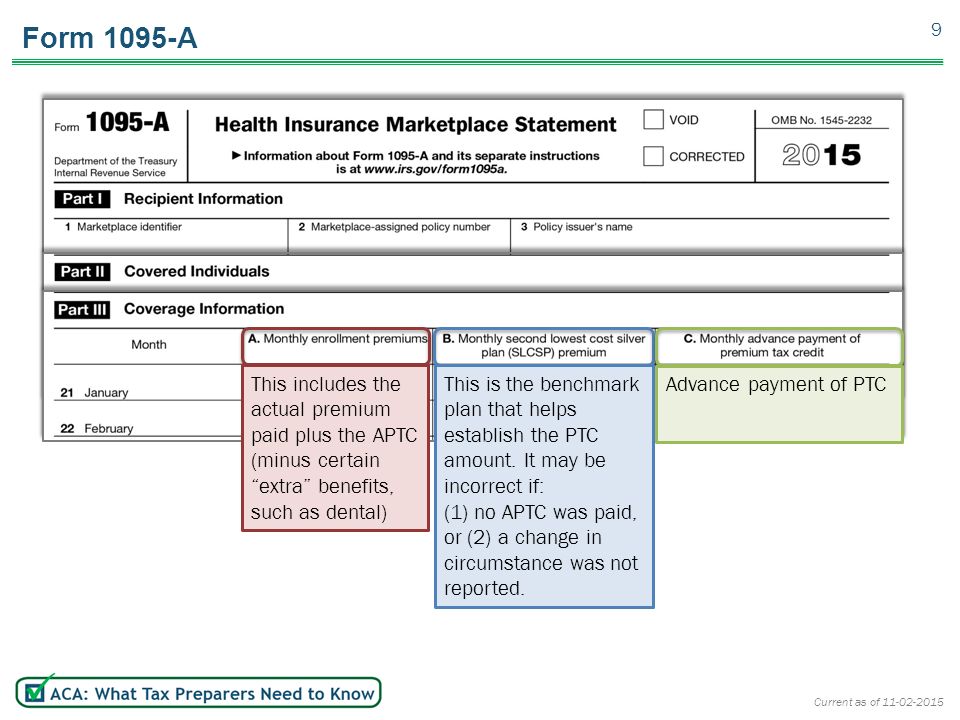

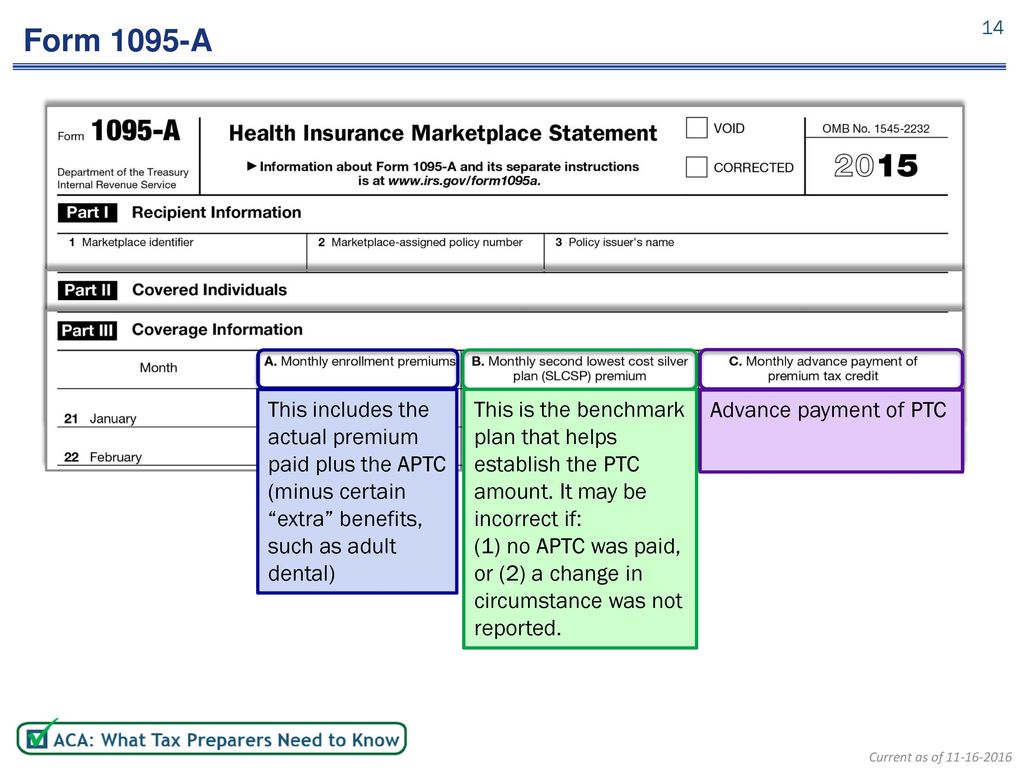

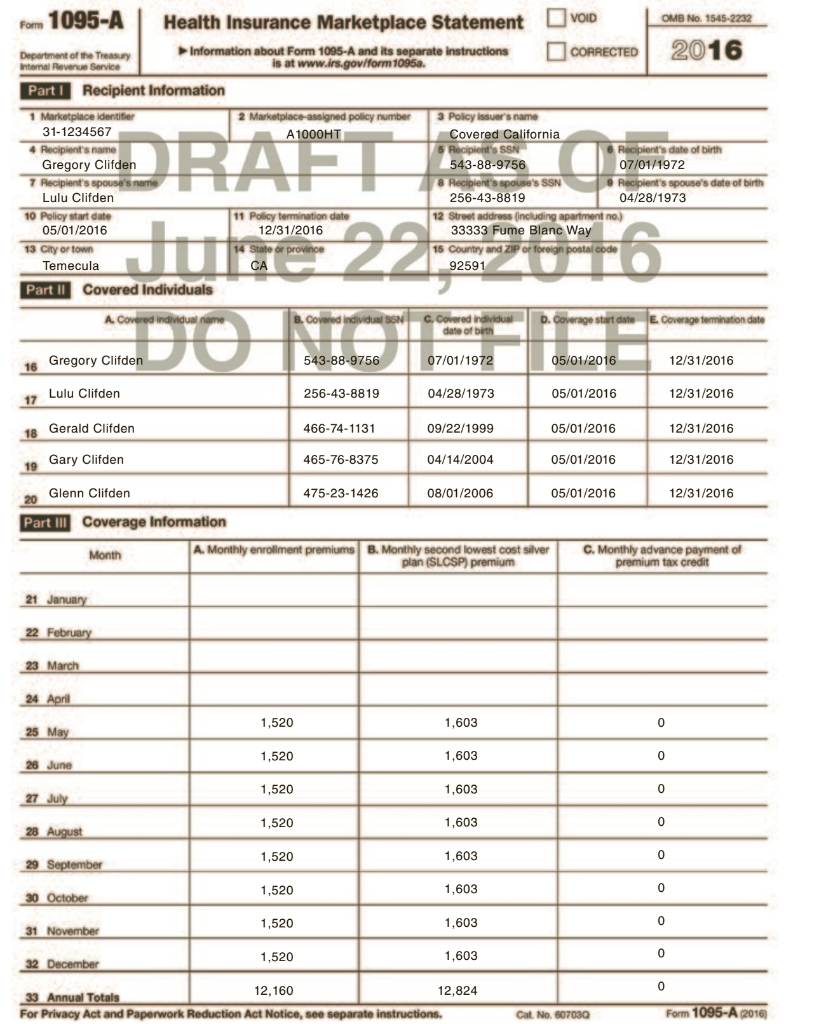

How to get marketplace 1095 form-In this case, your Form 1095A will show only the premium for the parts of the month coverage was provided You were enrolled in a standalone dental plan and a dependent under 18 was enrolled in it In this case, the monthly enrollment premium on your Form 1095A may be higher than you expect because it includes a portion of the dental plan premiums for pediatric benefits · Form 1095C complements two other health insurance disclosures Form 1095A, provided by your state's healthcare marketplace, and Form 1095B, supplied by the health insurer your employer used

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

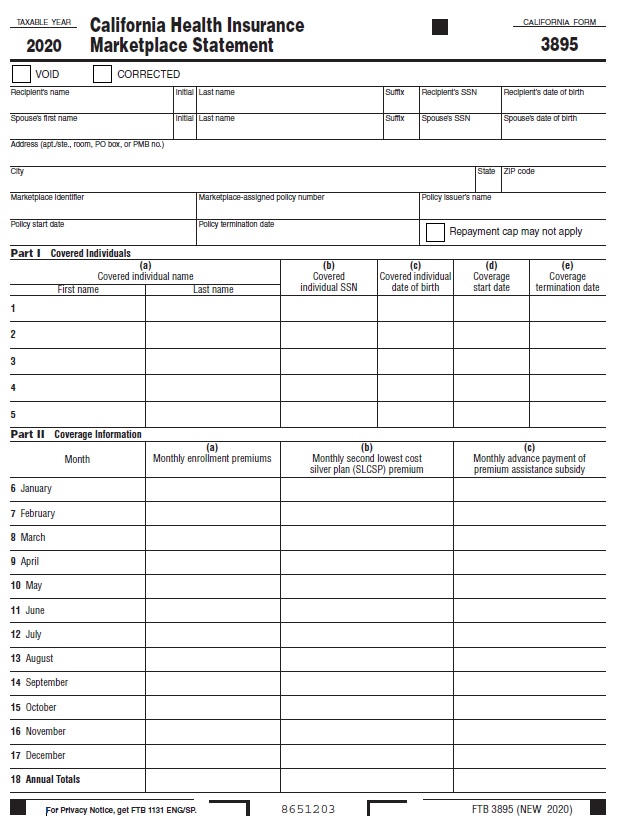

Please contact the IRS or the entity responsible for sending you the form · Form 1095A –Individuals who enroll in health insurance through Covered California or the Federal Marketplace will get this form Form 1095B –Individuals who enroll in health insurance through MediCal, Medicare, and other insurance companies or coverage providers will receive this form Form 1095C –Individuals who enroll in health insurance through their employers will receive this formAnd 1095B • Publication 35C, California Instructions for Filing Federal Forms 1094C and 1095C General Information Purpose Form FTB 35, California Health Insurance Marketplace Statement, is used to report certain information to the Franchise Tax Board (FTB) about individuals who enroll in a qualified health plan through the

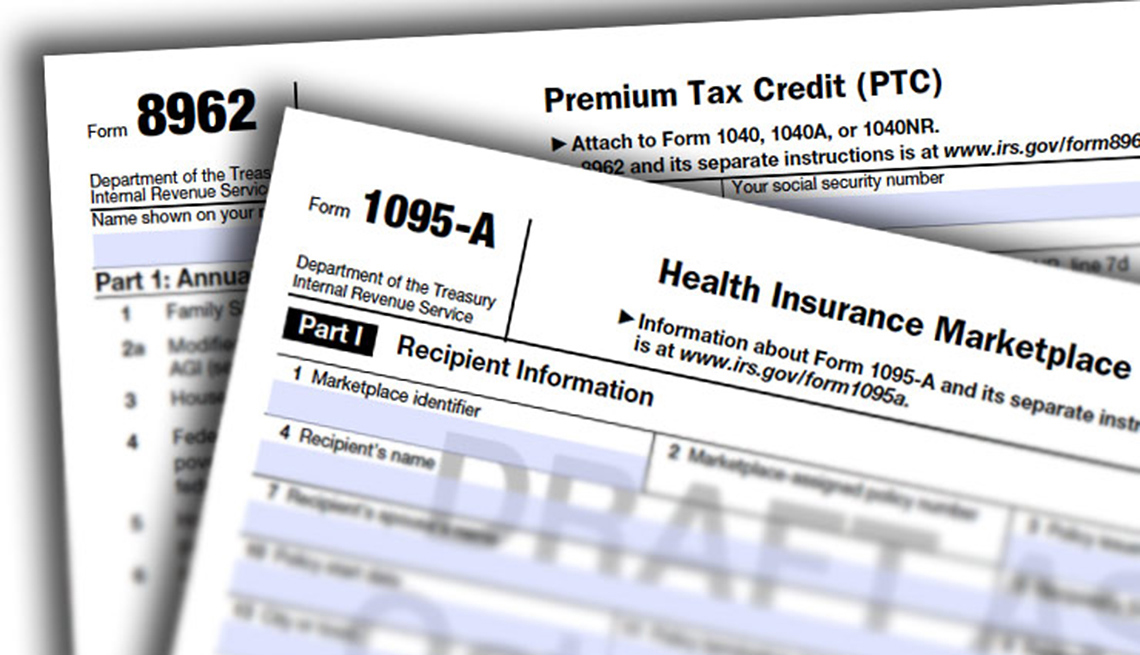

· The main difference between Form 1095B and 1095A is that Form 1095B shows one purchased coverage through an employer—not the Marketplace Also, if one is receiving Form 1095B, then he does not have to fill out Form 62 to affirm tax credits All the recipient has to do with this form is to hold on to the form for recordkeeping purposes CIf you do wish to claim the premium tax credit you will need Part II of Form 1095C · If anyone in your household had Marketplace health coverage in , you should have already received Form 1095A, Health Insurance Marketplace® Statement (If you didn't get the form online or by mail, contact the Marketplace Call Center) How to use Form 1095A If your form is accurate, you'll use it to "reconcile" your premium tax credit

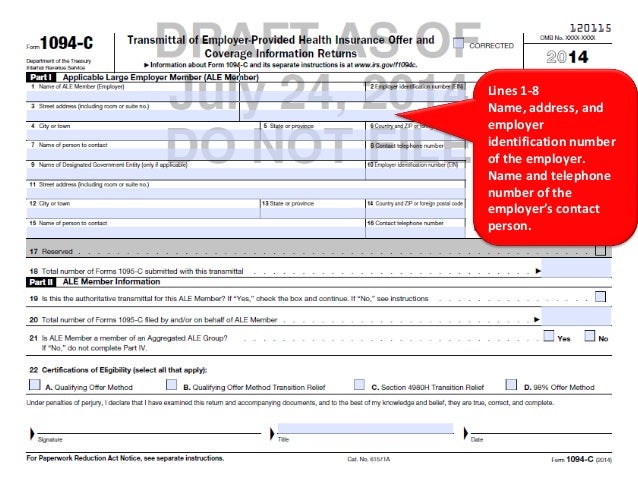

A 1095C forms are generated by the Service Pay Centers The Pay Centers will provide the forms to the Service member, Retiree, or Annuitant between January 1 and March 2, Pay Centers are required to provide 1095C forms However, Pay Centers are no longer required to provide 1095B forms unless you request oneTax Form 1095A Original Form IRS Tax Form 1095 –A Purposes of this form are to document Length of Marketplace coverage Tax Household Members Any dollar amounts of federal subsidy paid to the insurance company to reduce the premium Provides contact information, language options and resources for additional assistance · Form 1095B is for information onlyand is issued by your health insurance provider It is not from the Marketplace and has no Marketplace policy number on it You do not enter form 1095B on your tax return Only form 1095A is from the Marketplace

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Form 1095 A 1095 B 1095 C And Instructions

You could receive Form 1095A from Washington Healthplanfinder online, Form 1095B from Premera, or Form 1095B or 1095C directly from your employer It's likely you'll receive a Form 1095 from all of those entities, in the mail or online Questions? · The corrected Form 1095C must be provided to the employee if they were earlier provided the incorrect form 1094B/1095B Materials The final instructions are available here The 16 Form 1094A There are different 1095 forms

9 Aca Affordable Care Act Software Ideas Irs Forms Tax Forms Efile

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095A () Page 2 Instructions for Recipient You received this Form 1095A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace This Form 1095A provides information you need to complete Form 62, Premium Tax Credit (PTC) You must complete · The Codes on Form 1095C Explained February 24, Robert Sheen Affordable Care Act 3 minute read Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRSThe 1095 is used to help you fill out forms like form 62 for tax credits and is used to prove you had coverage A copy is sent to you and the IRS If a 1095A, the kind the marketplace sends, was never sent out to the policy holder, then it could cause issues

Form 1095 A Health Insurance Marketplace Statement 15 Free Download

Irs Form 1095 Form Ftb 35 And Your Health Insurance Subsidy In The Coveredca Faq Youtube

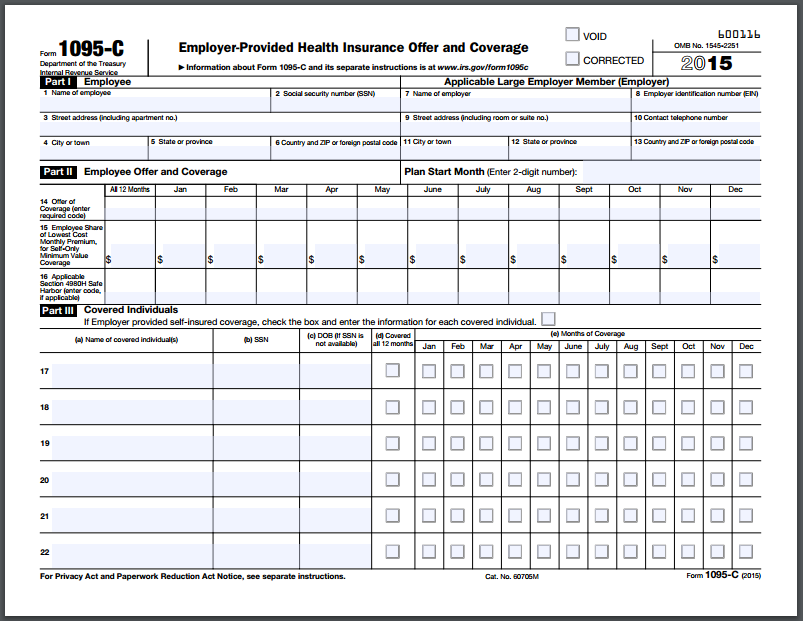

1095C submissions and corrected IRS Form 1095C submissions – they need to be transmitted separately Our application allows you to select between Original and Corrected •It is possible to submit a corrected IRS Form 1094C without any corresponding IRS Form 1095C–for example •Total employee count was wrong for a monthIf you did not enroll in a health plan in the Marketplace, the information contained in Part II of your 1095C form is not relevant Use form 1095C for information on whether you or your family members enrolled in certain kinds of coverage offered by your employer sometimes referred to as "selfinsured coverage" · If you did not receive your Form 1095A, you should contact the Marketplace from which you received coverage to get a copy You are not required to send in proof of health care coverage, including Form 1095A, to the IRS when filing your tax return However, it's a good idea to keep these records on hand to verify coverage

Tax Season Complicated By New Health Insurance Forms Health Bendbulletin Com

Form 1095 A Community Tax

· Download your tax form from Kaiser Permanente For members expecting to receive a 1095A from the marketplace, a 1095B from the government, may receive a Form 1095B or 1095C directly from their health insurance company Each Marketplace health plan has a unique 14character identifier that's a combination of numbers and/or letters · The Form 1095A will be sent to individuals enrolled in 14 health coverage on the Health Insurance Marketplace Consumers will use the information included on Form 1095A to complete Form 62 , Premium Tax Credit (PTC), and to assist them in answering the question on Form 1040, 1040A, or 1040EZ about satisfaction of the Affordable Care Act's individual sharedForm 1095C, EmployerProvided Health Insurance Offer and Coverage, reports whether your employer offered you health insurance coverage and information about what coverage was offered to you This form is f or your information only and is not included in your tax return unless you purchased health insurance through the progress in addition to this

16 Federal Tax Updates Richard Furlong Jr Senior

The Affordable Care Act Aca Reporting And Disclosure Baker Tilly

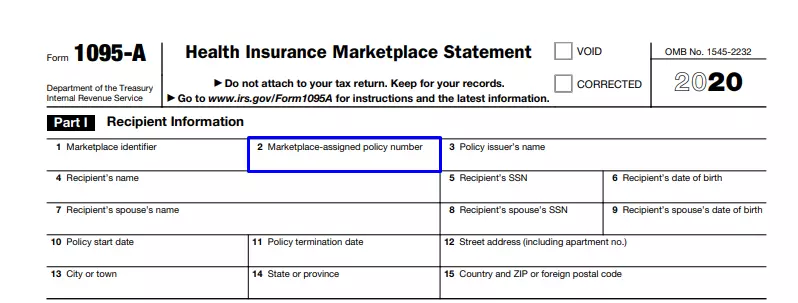

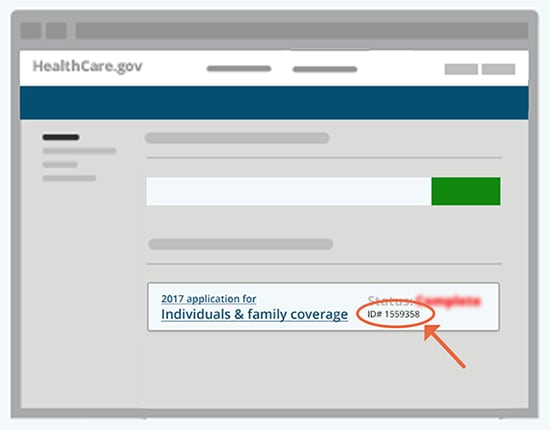

· Solved Whats a Market Identifier ?1095 a A taxesThe resources on this page provide information about your Form 1095A from NY State of Health The Form 1095A is used to reconcile Advance Premium Tax Credits (APTC) and to claim Premium Tax Credits (PTC) on your federal tax returnsThe 1095 is a tax form that shows the health care coverage you had in the previous year Due to recent tax law changes 1, if you bought your health plan directly from Blue Cross and Blue Shield of New Mexico (BCBSNM) 2 or got your BCBSNM health plan through your job 3, the IRS says you no longer need Form 1095B to file your federal income taxesThis change is as of January 21

Covered California Ftb 35 And 1095a Statements

1095 A Software 1095 A Software

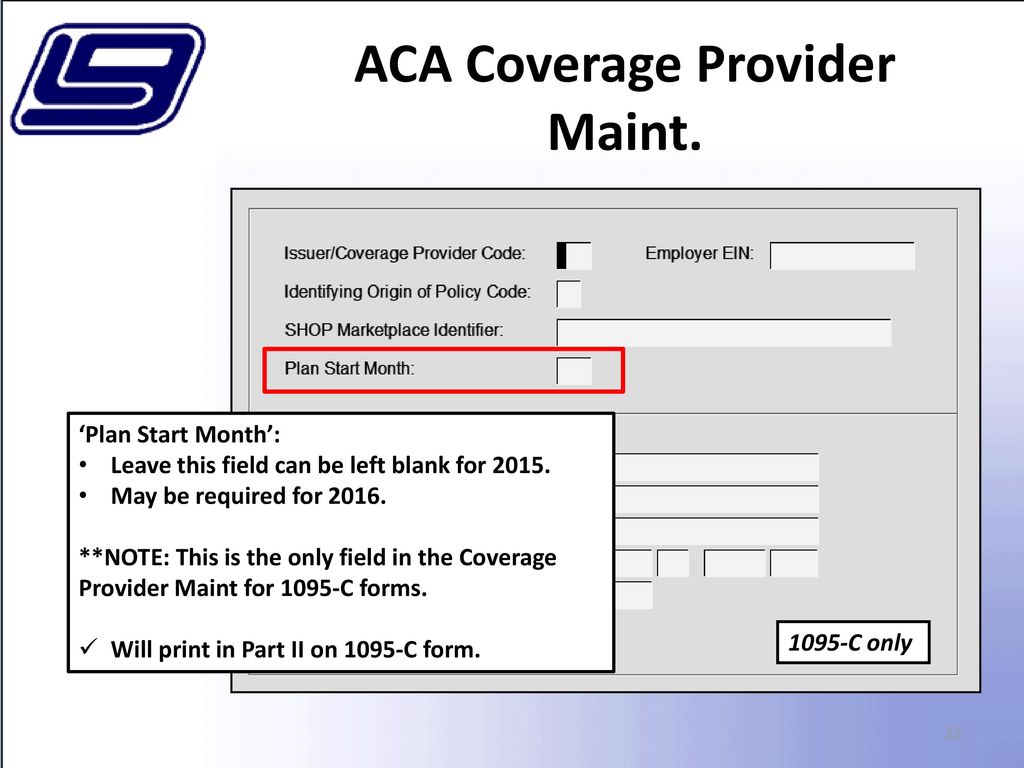

Form 1095B Line 9 is now "Reserved" On the 15 version of the form, this line was to report the Small Business Health Options Program (SHOP) Marketplace identifier, if applicable, but should have been left blank according to the 15 instructionsIn this case, your Form 1095A will show only the premium for the parts of the month coverage was provided You were enrolled in a standalone dental plan and a dependent under 18 was enrolled in it In this case, the monthly enrollment premium on your Form 1095A may be higher than you expect because it includes a portion of the dental plan premiums for pediatric benefitsForm 1095B An IRS Form sent to individuals who received minimum essential coverage as defined by the Affordable Care Act

State Health Insurance Markets Struggle With Cost Challenges

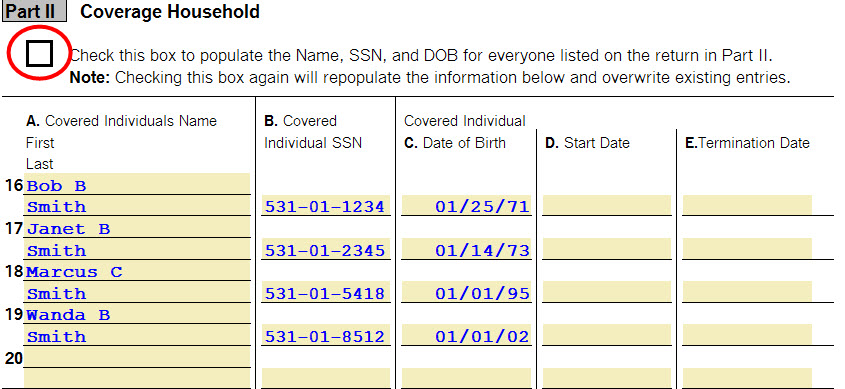

Zortec Payroll Affordable Care Act Ppt Download

If you had a selfinsured group health plan with BCBSTX, your employer sends you a 1095C form If you had a BCBSTX plan through the Health Insurance Marketplace in Texas, the Marketplace may send you a 1095A form Q3 I got a 1095A form from the Marketplace/Exchange Is that different?Type 1095C and click Create new copy Enter the Employer Name and click Create Check the box to indicate if owned by Taxpayer or Spouse Part I Employee Lines 1, 2, 3, 4, 5, and 6 will be completed based on the ownership box checked Line 7 is completed when entering the name of the Employer for the copy Line 8 EIN of the EmployerFAQ for IRS Tax Form 1095B Overview What is Form 1095B?

Form 1095 A 1095 B 1095 C And Instructions

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Form 1095B shows the months that HUSKY Health beneficiaries were enrolled in Medicaid or the Children's Health Insurance Program This form is needed to prepare for filing a federal tax return When filing taxes, most people are required to report if they had · The law still requires a Form 1095B to be filed with the IRS, but taxpayers do not generally need this Form in order to prepare their individual returns for 19 Therefore, the announcement refers to the "19 section 6055 furnishing relief" and provides that the penalty for failing to furnish a Form 1095B to an insured party will be waived for 19 if two conditions areThe 1095 is a tax form that shows the health care coverage you had in the previous year Due to recent tax law changes 1, if you bought your health plan directly from Blue Cross and Blue Shield of Illinois (BCBSIL) 2 or got your BCBSIL health plan through your job 3, the IRS says you no longer need Form 1095B to file your federal income taxes

How To Delete 1095 A Form

Watch For Your 1095 Tax Form Bancorp Insurance Call 800 452 66

See the Instructions for Forms 1094C and 1095C for more information about who must file Forms 1094C and 1095C and for more information about reporting coverage for nonemployees Small employers that aren't subject to the employer shared responsibility provisions sponsoring selfinsured group health plans will use Forms 1094B and 1095B to report information aboutThe "Marketplace" is the government's term for the online insurance markets or "exchanges" set up under the law known as Obamacare Only people who buy coverage through the Marketplace are eligible for the Premium Tax Credit If you bought your plan there, you should get a Form 1095A, also called the "Health Insurance Marketplace Statement" · Basic Information about Form 1095A If you or anyone in your household enrolled in a health plan through the Health Insurance Marketplace, you'll get Form 1095A, Health Insurance Marketplace StatementYou will get this form from the Marketplace, not the IRS;

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095 A 1095 B 1095 C And Instructions

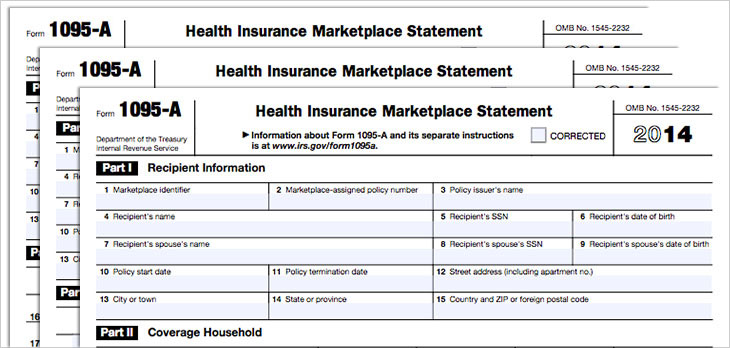

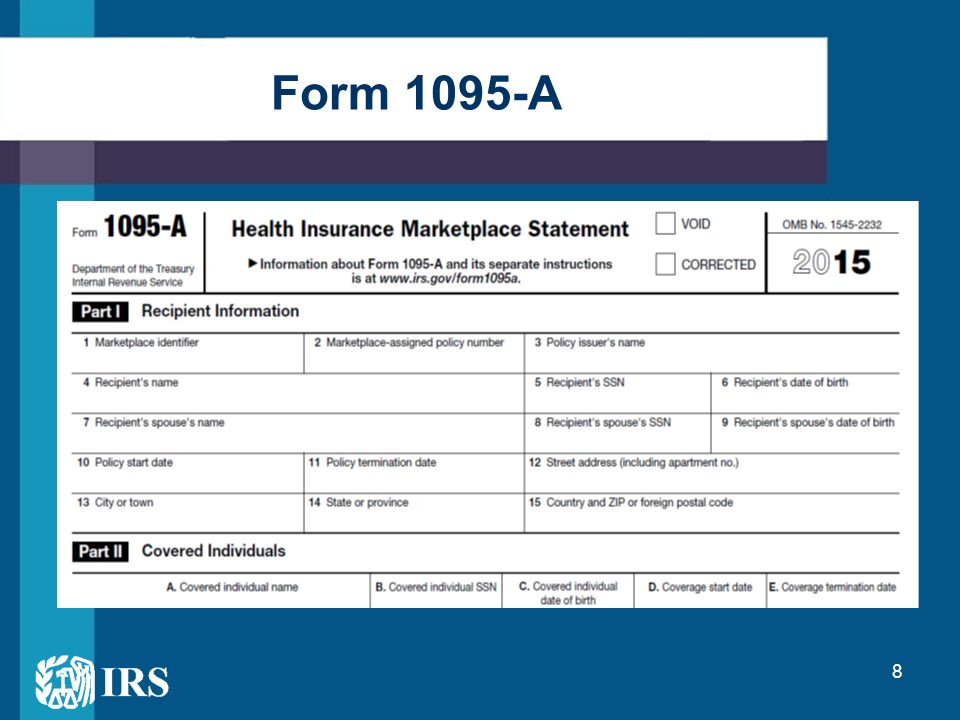

You will use the information from the Form 1095A to calculate the amount of your premium tax creditForm 1095A (14) Page 2 Instructions for Recipient You received this Form 1095A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace This Form 1095A provides information you need to complete Form 62, Premium Tax Credit (PTC)Form 1095A is mailed to subscribers from the Marketplace at the beginning of the year Form 1095A must be used to demonstrate proof of coverage and reconcile premium tax credits You may need your form to show proof of medical health plan coverage when filing your tax returns with a

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

· Click on the screen Form 1095A Health Insurance Marketplace Statement from the left navigation panel Complete the Recipient Information (Part I) section (from Form 1095A) The Recipient Information will not flow to a form or schedule This is all informational Check the box, Spouse is recipient (if applicable) Enter the (1) Marketplace identifierLine 8 in Form 1095B is to identify the origin of policy and line 9 is for SHOP marketplace identifierAnd the marketplace assigned policy number???

4 New Hardship Exemptions Let Consumers Avoid Aca Penalty For Not Having Health Insurancekaiser Health News

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

· Fill Online, Printable, Fillable, Blank form 1095a health insurance marketplace statement pdf Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable1 Marketplace identifier 2 Marketplaceassigned policy number 3 Policy issuer's name Marketplace This Form 1095 A provides information you need to complete Form 62, Premium Tax Credit (PTC) You must complete Form 62 and file it with your tax return (Form 1040, FormForms 1095C those employees You will receive a copy of Form 1095C because you were a fulltime employee for all or some months of the prior calendar year You are receiving a copy of the Form 1095C so you know what information has been reported to the IRS about the offer of health coverage made to you and your family

Aca Compliance Reporting Morris Reynolds Insurance

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

· If you're getting a 1095B from Kaiser Permanente, you'll be able to access your 1095B form through kporg Sign on to consent to receive the form(s) electronically, then download copies of your form For members expecting to receive a 1095A from the marketplace, a 1095B from the government, or a 1095C from their employer, pleaseYour 1095A Form Statement Date Any customer who enrolled in a Qualified Health Plan through Washington Healthplanfinder at any time during 14 will get an important NEW tax return document from Washington Healthplanfinder called the 1095A Health Insurance Marketplace

Cengage Resource Center

Re 62 Form

The Affordable Care Act Taxes A Resource For

1095 A Tax Form H R Block

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

What Is Form 1095 C And Do You Need It To File Your Taxes

Covered California Ftb 35 And 1095a Statements

Annual Health Care Coverage Statements

1 0 9 5 A P R I N T A B L E F O R M Zonealarm Results

O B A M A C A R E 1 0 9 5 A F O R M Zonealarm Results

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Form 1095 A Fill Out Printable Pdf Forms Online

Fill Free Fillable Form 1095 A Health Insurance Marketplace Statement Pdf Pdf Form

Entering Form 1095 A 1095 B Or 1095 C Health Cove Intuit Accountants Community

Part Ii Advanced Certification Ppt Download

Form 1095 A 1095 B 1095 C And Instructions

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Abcs Of The Premium Tax Credit Internal Revenue

Form 1095 A Community Tax

Patient Protection And Affordable Care Act Ppaca Better Known As Aca Ppt Download

2 0 2 0 P R I N T A B L E 1 0 9 5 A F O R M T A X E S Zonealarm Results

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

Accounter High Resolution Stock Photography And Images Alamy

Vita Tce Advanced Topic Ppt Download

Application Id Healthcare Gov Glossary Healthcare Gov

Health Care Reform Update

What Are 1095 Tax Forms San Diego Sharp Health News

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

Aca Repeal Or Replace Doesn T Change Form 1095 Filing Requirements Press Posts

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

125 1095 Photos Free Royalty Free Stock Photos From Dreamstime

Automated Ppaca And Irs Reporting

125 1095 Photos Free Royalty Free Stock Photos From Dreamstime

Federal Income Tax On Health Insurance Lovetoknow

Welcome To Aca Compliance

Rrd Alternative Channel 15 Tax Forms Page 15

Benefitscape Benefitscape Twitter

Comprehensive Problem Two Gregory And Lulu Clifden Chegg Com

Form 1095 C Guide For Employees Contact Us

How To Get Form 1095 A Health Insurance Marketplace Statement Picshealth

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Blog Healthcare Counts

How To Get Marketplace 1095 Form

What Is Form 1095 C And Do You Need It To File Your Taxes

Irs Form 1095 A Fill Out Printable Pdf Forms Online

How To Get Form 1095 A Health Insurance Marketplace Statement Picshealth

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Tax Season Is Here Know Your Forms Enroll Nebraska

Do You Own More Than 2 Percent Of Your S Corporation Meese Khan Llp

Form 1095 A Community Tax

0 件のコメント:

コメントを投稿